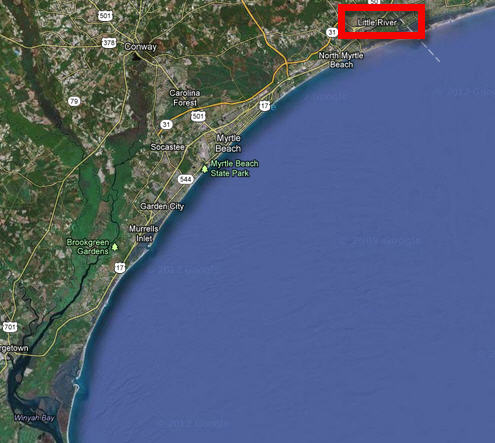

Why do I live/love Myrtle Beach? The Beach #1!!! White sandy beaches spanning 60 miles from Little River to Pawleys Island. Myrtle Beach has something for everyone from 1 to 100 !!! Amusements, shopping, shows, boating, and of course golf! There are over 102 courses along the Grand Strand and Myrtle Beach hosts numerous golf events including the Hootie & The Blowfish Monday After the Masters Celebrity Pro-Am. Deciding to move to the Myrtle Beach area is the easy part.... deciding what part of the beach is your challenge. Today I will start highlighting the areas starting with the north end. Little River was the first village established in Horry County. Indian Tribes called the stream Mineola, meaning “little river,” and that became its name. To read more about the history of Little River click here . Little River offers affordable housing, nearby golf, great restaurants,boating and easy access to Highway 17. Minutes...

Comments

Post a Comment