Understanding Capital Gains in Real Estate

Understanding Capital Gains in Real Estate

When you sell a stock, you owe taxes on your gain — the difference between what you paid for the stock and what you sold it for. The same holds true when selling a home (or a second home), but there are some special considerations.

How to Calculate Gain

In real estate, capital gains are based not on what you paid for the home, but on its adjusted cost basis. To calculate, follow these steps:

1. Purchase price: _______________________

When you sell a stock, you owe taxes on your gain — the difference between what you paid for the stock and what you sold it for. The same holds true when selling a home (or a second home), but there are some special considerations.

How to Calculate Gain

In real estate, capital gains are based not on what you paid for the home, but on its adjusted cost basis. To calculate, follow these steps:

1. Purchase price: _______________________

The purchase price of the home is the sale price, not the amount

of money you actually contributed at closing.

2. Total adjustments: _______________________

To calculate this, add the following:

- Cost of the purchase — including

transfer fees, attorney fees, and inspections, but not points you paid on

your mortgage.

- Cost of sale — including

inspections, attorney fees, real estate commission, and money you spent to

fix up your home just prior to sale.

- Cost of improvements — including

room additions, deck, etc. Note here that improvements do not include

repairing or replacing something already there, such as putting on a new

roof or buying a new furnace.

3. Your home’s adjusted cost basis: _______________________

The total of your purchase price and adjustments is the adjusted

cost basis of your home.

4. Your capital gain: _______________________

4. Your capital gain: _______________________

Subtract the adjusted cost basis from the amount your home sells

for to get your capital gain.

A Special Real Estate Exemption for

Capital Gains

Since 1997, up to $250,000 in capital gains ($500,000 for a married couple) on the sale of a home is exempt from taxation if you meet the following criteria:

Since 1997, up to $250,000 in capital gains ($500,000 for a married couple) on the sale of a home is exempt from taxation if you meet the following criteria:

·

You have lived in the home as your principal residence for two out

of the last five years.

·

You have not sold or exchanged another home during the two years

preceding the sale.

·

You meet what the IRS calls “unforeseen circumstances,” such as

job loss, divorce, or family medical emergency.

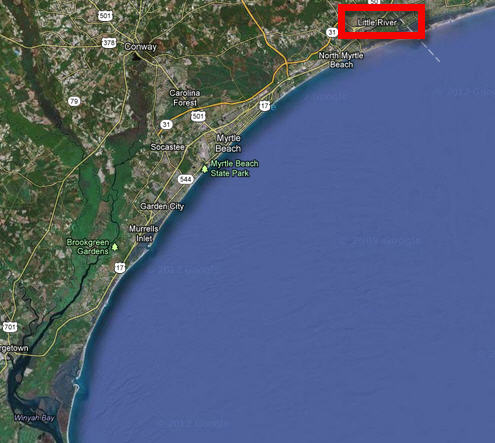

Moving to South Carolina - check out the SC Page on Taxes

Sue Lucas

Broker Associate

Re/Max Southern Shores

843-997-4595

Reprinted from

REALTOR® magazine (REALTOR.org/realtormag)

with permission of the NATIONAL ASSOCIATION OF REALTORS®.

Copyright 2008. All rights reserved

Comments

Post a Comment